DeMarker indicator: guide to using it in binary options

DeMarker (DeM) is an advanced oscillator designed to accurately identify moments of market overbought and oversold conditions. Unlike many other indicators, it minimizes volatility and better identifies trend reversal points. For binary options traders, DeMarker is an effective tool for finding entry points for trades with an expiration of 1-5 minutes. In this guide, you will learn how to correctly interpret its signals and apply them in trading.

What is the DeMarker indicator and how does it work?

The DeMarker (DeM) indicator measures demand for an asset by comparing the current price with the price of the previous period. The main idea behind the indicator is to determine when buyers or sellers have exhausted their strength and are ready for a reversal.

Calculation formula:

Calculate the DeMax value: if the current maximum is higher than the previous one, DeMax = current maximum - previous maximum. Otherwise, DeMax = 0.

Calculate the DeMin value: if the current minimum is lower than the previous one, DeMin = previous minimum - current minimum. Otherwise, DeMin = 0.

DeMarker value = SMA(DeMax, N) / [SMA(DeMax, N) + SMA(DeMin, N)]

Where N is the indicator period (usually 14).

Setting up DeMarker in the trading platform

Setting up the indicator is simple and does not require changing the standard parameters:

In the indicators menu, select “DeMarker” (may be labeled as DeM)

The default period is 14 (optimal for M1-M15 timeframes)

Levels 0.7 and 0.3 are standard for determining overbought/oversold zones

For better visualization, you can customize the colors of lines and levels

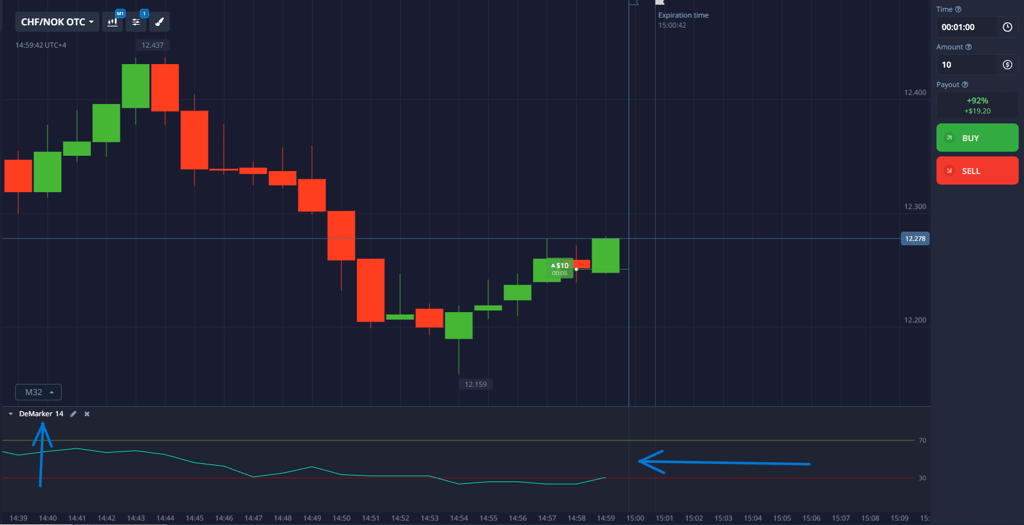

DeMarker trading signals for binary options

1. BUY signal (Call):

The indicator leaves the oversold zone (below 0.3)

The DeMarker line crosses the 0.3 level from below

The price confirms the reversal with an upward movement

Expiration: 1-5 minutes

2. Signal to SELL (Put):

The indicator leaves the overbought zone (above 0.7)

The DeMarker line crosses the 0.7 level from top to bottom

The price confirms the reversal with a downward movement

Expiration: 1-5 minutes

3. Divergence is the strongest signal:

Bullish divergence: the price updates its lows, while the DeMarker forms a higher low

Bearish divergence: the price updates its highs, while the DeMarker forms a lower high

Practical trading strategy with DeMarker

“Rebound from Levels” Strategy:

Wait for the indicator to reach extreme levels (0.3 or 0.7)

Wait for the indicator to start reversing

Look for confirmation on the price chart (reversal candlestick patterns)

Enter the trade in the direction of the reversal.

Set the expiration time to 3-5 minutes.

Important nuances:

In strong trend conditions, the indicator may remain in overbought/oversold zones for a long time.

Signals are more reliable on M5 timeframes and above.

Always use confirmation from price action.

Combining with other instruments

To increase effectiveness, use DeMarker in combination with:

Moving averages (EMA 20/50) - to determine the general direction of the trend

Support/resistance levels - signals at key levels are more reliable

Candlestick patterns - to confirm reversal signals

Trading volumes - to confirm the strength of the movement

Risk management:

Size of a single trade - no more than 2-3% of the deposit

Profit-to-risk ratio - at least 1:2

Do not open more than 3 trades in a row in the same direction

Conclusion

DeMarker is a powerful tool in the arsenal of a binary options trader, especially effective in flat conditions and during trend corrections. Its main advantage is its ability to signal possible market reversals in advance. However, like any oscillator, DeMarker works best in combination with other technical analysis tools. Proper use of DeMarker in combination with strict capital management discipline can significantly increase the effectiveness of your trading.